- A $20,000 investment is made in a tiny job store to alter a material-handling system. This amendment would result in first-year savings of $2,000, second-year savings of $4,000, and subsequent year savings of $5,000. How many years does the framework last if an 18 percent return on investment is required? The system is optimized for this job shop and at any moment has no market value (salvage).

- In 1789, the first U.S. Congress fixed the president’s pay at $25,000 a year. The president’s salary is $400,000 per annum in 2014. What is the compounded annual average growth in the salary of the president over the past 225 years?

- One of life’s great lessons is to get started early and save all the money you can! If you save $2 today and $2 each and every day when you’re 60 (say $730 a year for 35 years), how much money can you gain if the average interest rate is 7 percent?

- What lump-sum interest will be paid on a $10,000 loan made on August 1, 2012, and repaid on November 1, 2016, with ordinary simple interest at 10 percent per annum?

- Your spendthrift cousin needs $425 to purchase a fancy watch. You recommend instead that she buy a cheap watch for $25 and save the $400 difference. Your cousin agrees with your premise and invests $400 in an account paying 9% interest each year for 40 years. After 40 years have passed, how much will she accumulate in this account?

- The oil price was $67 per barrel in 2004. A government publication states, “This price is indeed lower than the price of oil in 1980.” If from 1980 to 2004 inflation averaged 3.2 percent per year, what was the price per barrel of oil in 1980?

- What nominal rate per month is equal to an effective, continuously compounded 1.3 percent per month?

- Heyden Motion Solutions ordered $7 million worth of seamless tubes for its drill collars from the Timken Company of Canton, Ohio. (A drill collar is the heavy tubular connection between a drill pipe and a drill bit.) At 12% per year, compounded semiannually, what is the equivalent uniform cost per semiannual period over a 5-year amortization period?

- For assembling its new Dreamliner Commercial airliner, Boeing has ordered composite wing fixtures. Assume that it costs $3 million to install this device and an extra $200,000 a year for all costs of supplies, service, workers, and maintenance. 10 years is a planned life. For each 6-month cycle that is required to recover the investment, interest, and annual costs, an engineer needs to estimate the total revenue requirement. If capital funds are measured at 8 percent per year, compounded semiannually, considering this semiannual A benefit.

Topic: Equivalence Relations: Series with PP>=CP

- Determine the present value difference of the following two contracts at an interest rate of 8 percent per year.

- In year 1, contract 1 has a cost of $10,000; for 10 years, costs would rise at a rate of 4 percent per year.

- Contract 2 has the same cost in year 1, but for 11 years, costs will rise to 6 percent per annum.

- By better balancing the size of the goods to be delivered to the size of the shipping container, a business that sells high-purity laboratory chemicals is considering investing in new equipment that would minimize cardboard costs. If the procurement and construction of the new equipment cost $220,000, how much does the company save every year for 3 years to justify the investment if the interest rate is 10 percent a year?

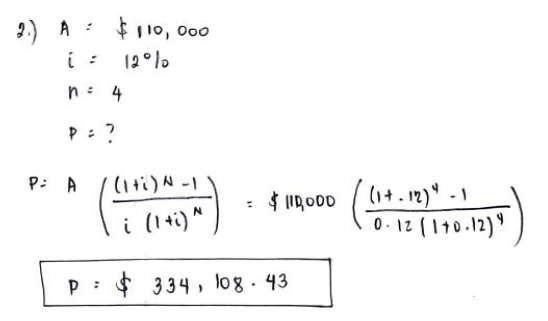

As reagents bind to the ceramic piston and deteriorate the seal, syringe pumps frequently fail. Trident Chemical proposed an effective polymer fluid seal that provides the sealing lip with a higher sealing force resulting in extended sealing life. One of Trident’s customers expects the latest seal configuration to minimize downtime by 30 percent. If lost production for the next four years would cost the company $110,000 a year, how much will the company afford to spend on the new seals now if it uses an interest rate of 12 percent per year?

- Evaluate the present worth of a sequence of geometric gradients with a $50,000 cash flow in year 1 and a rise of 6 percent per year through year 8. The rate of interest per year is 10 percent.

- For the period from Jan. 15 to Nov. 28, 2020, calculate the simple interest on P5,000, if the interest rate is 22 percent.

- What is the annual interest rate if a P15,000 investment receives $265 in 4 months?

- What is the future equivalent of P10 000 invested for 4 & 1/2 years at 10% simple interest per year?